How We Grew Our Payments Startup To 2.5 Million Users in 12 Months

Play to your strengths, outsource your weaknesses, and partner for insights

Never has there been a better time to build a payments startup. The shift in consumer demands towards digital and contactless payments provides a plethora of opportunities for software solutions to enable all kinds of innovative purchase interactions.

While hundreds of fintech and payment startups are launched each day, each trying to be the next Stripe, Square, PayPal, or Klarna, many don’t make it. According to the Startup Genome, 11 out of 12 (92%) startups fail. According to Failory, the large majority of reasons were related to Product-Market Fit (34%), Marketing (22%), and Team Problems (18%).

With up to 74% of reasons relating to product and marketing, startups must carefully evaluate its strategic choices, partnerships, and product design.

In this article, I’ll be outlining the steps we took at Littlepay to ensure we wouldn’t fail, and how we grew our business to 2.5 million unique users after 12 months. The steps cover the following:

Step 1: Figure out customer’s #1 problem through obsessive discovery and validation

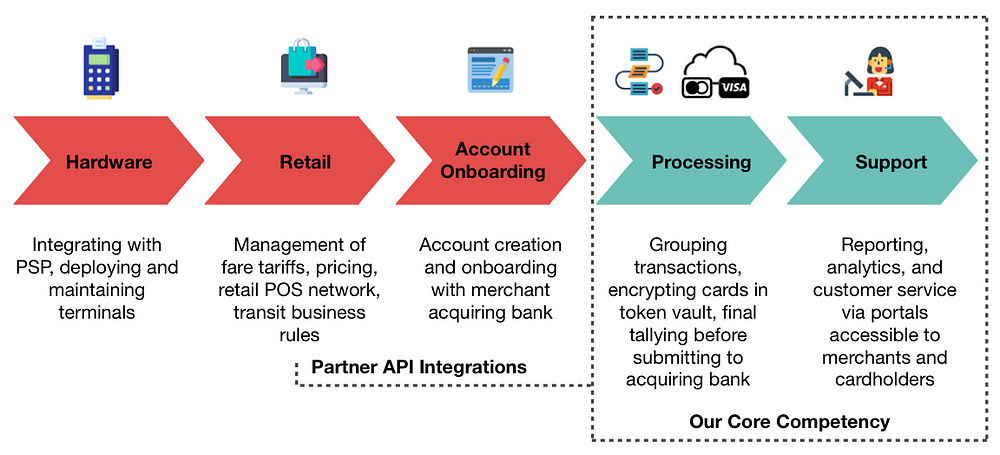

Step 2: Know your place in the value chain and understand your core competencies.

Step 3: Integrate with your non-core competency value chain partners.

Step 4: Establish a strategic partnership with an influential pilot customer.

Step 5: Co-create with your pilot customers and partners. Inculcate the safety to say “No”.

Step 6: Clarify requirements, and implement frequent cadence during iterative development.

Step 7: Implement hyper-care support. Carve out capacity to fix production bugs.

Step 8: Measure, Learn, Build, and Repeat.

Step 1: Figure out your customer’s #1 problem through obsessive discovery.

In the early days, sit alongside your prospective customers to understand how they work, their jobs-to-be-done, their needs and motivations. The more you live and breathe your customer environment, the more you will get to understand their problems and the biggest pinpoints they need solving.

Start making a log of problem statements in the form of facts, assumptions or hypotheses you need to validate. Your understanding of the problem will allow you to design how lean your minimum viable product can be. Use rough estimations (e.g., t-shirt sizing, low/medium/high, fibonnacci) with your technical teams for guidance on priority.

At Littlepay, we observed how bus operator companies worked by performing ethnographic studies to see how cash was handled on buses, interviewed drivers and support staff on their daily jobs-to-be-done, and created problem statements and personas along the way.

It turns out that the UK bus industry lacked a compelling solution at a price point that suited them: they could not afford a multi-million-pound investment to build a new solution every time. They needed an easy way to accept contactless bank cards on-bus, through a service that was easy to understand and adopt.

Based on our discovery, we created our first elevator pitch, thanks to Adeo Ressi’s one-line elevator pitch template:

🚌 💳 Littlepay is a specialist payment services provider for the mass transit and digital mobility industry. We help transit agencies and operators accept Visa/MasterCard contactless taps and e-commerce purchases through one core platform in the cloud, rapidly deployable through validator partners and APIs.

Step 2: Know your place in the value chain and understand your core competencies.

The “payments industry” is more like a collection of clustered industries with functionality overlapping in often inefficient ways. New entrants must familiarise themselves with their competitive landscape and value chain.

For example, if you are a business that processes bank card payments, you are on what’s called the “merchant acquiring” side of the payments industry acting on behalf of a merchant.

At Littlepay, we needed to process transactions and clear and settle them via card schemes: Visa and MasterCard.

We quickly made two very significant value chain decisions:

Instead of selling hardware and managing the software on them, we focused on publishing unified APIs to allow connectivity from any contactless validator to submit us their payments.

Instead of becoming our own merchant acquirer, which has its own regulatory and cost challenges, we integrated with a strategic acquiring bank on partner terms.

We let the hardware and acquiring partners play to their strengths, as we did ours: reliable, cost-efficient, scalable payment processing!

Step 3: Integrate with your non-core competency value chain partners.

Your next priority is agreeing on which partners you need to integrate with, and negotiating with them to ensure each party benefits.

For Littlepay, we had two main partners:

Validator Hardware — Making this decision was not trivial and required significant due diligence by our target customers (the buyers of the hardware). Luckily, they chose a hardware partner (Ticketer) that had fantastic customer service and were willing to work closely with us during pilot.

Acquiring Bank — We decided to launch with an agile Icelandic wholesale acquiring bank: Valitor. Their acquiring platform was easily accessible to us via web services and had an in-house hardware certification team that could certify devices within a matter of weeks rather than months.

Once partners have agreed to work with you, you must map the integration points and messages to/from each partner. Your agreed integration method will help inform what kind of interfaces are needed and what processing is needed for an end-to-end transaction workflow.

Other things to be aware of during this period:

Changing interface scope — we used light documentation to ensure we agreed to flows on paper to provide clarity across all teams. A Scope of Works document usually helps here.

PCI compliance and integration certification activities — we found out that the acquiring bank needed evidence to reassure their risk and onboarding teams. Although we prefer interactions over documentation, we still had to document many systems and processes to demonstrate PCI Level 1 compliance.

3rd parties that are not ready to integrate with you via agreed flows— we built internal simulators that mimicked the calls made to our API endpoints by 3rd parties. We adjusted the payloads and responses along with changes to the integration points mentioned above.

At Littlepay, where our APIs weren’t used due to urgent delivery schedules, some technical debt was absorbed. Over time, we migrated vendors to a standard way of working: we published standard APIs over time to allow vendors to submit transactions to our platform safely and securely.